Making the best insurance plan choice might be important because it affects both your financial stability and general wellbeing. The following guidelines will assist you in selecting the best insurance option.

Determine Your Needs :

Knowing your individual insurance needs is a good place to start. Think on your current financial circumstances, your dependents, your future objectives, and any risks you want to reduce. Depending on your situation, you may require health insurance, life insurance, home insurance, auto insurance, or other sorts of insurance.

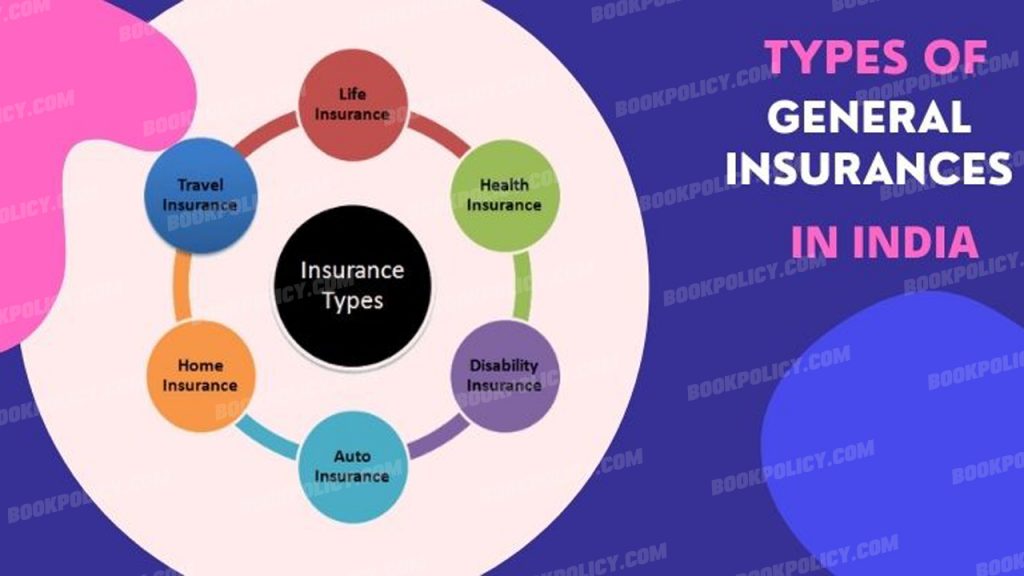

Recognize Different Insurance Types :

Learn about the many insurance policies that are offered, including health insurance, life insurance, disability insurance, auto insurance, house insurance, and others. Every type has a different function and provides differing amounts of coverage.

Establish a Budget :

Set up money for your insurance premiums. Decide how much insurance you can afford to pay for comfortably without putting a pressure on your finances. A larger premium may offer more comprehensive coverage, but it may not always be essential. Keep this in mind.

Find Insurance Companies :

Do some research on insurance providers and firms. Look for organizations with a solid reputation for providing excellent customer service as well as being financially healthy. You can evaluate an insurer’s reputation by looking at online reviews, ratings, and friend or family recommendations.

Examine Policies :

Obtain estimates for the sort of coverage you require from many insurance companies. Compare policies based on the scope of coverage, deductibles, costs, and other features. A cheaper premium may be exchanged for higher out-of-pocket expenses (deductibles and co-pays).

Review the policy details :

Make sure you have read and comprehended all of the policy’s terms and conditions. Pay close attention to any unique criteria or restrictions, as well as coverage limitations, exclusions, and waiting periods. If you have any questions, don’t be afraid to ask your insurance agent or representative.

Think About Your Particular Situation :

Make sure your insurance is tailored to your unique needs. For instance, if you have a family, life insurance may be necessary to support them in the event of your untimely demise. A must if you have dependents is health insurance.

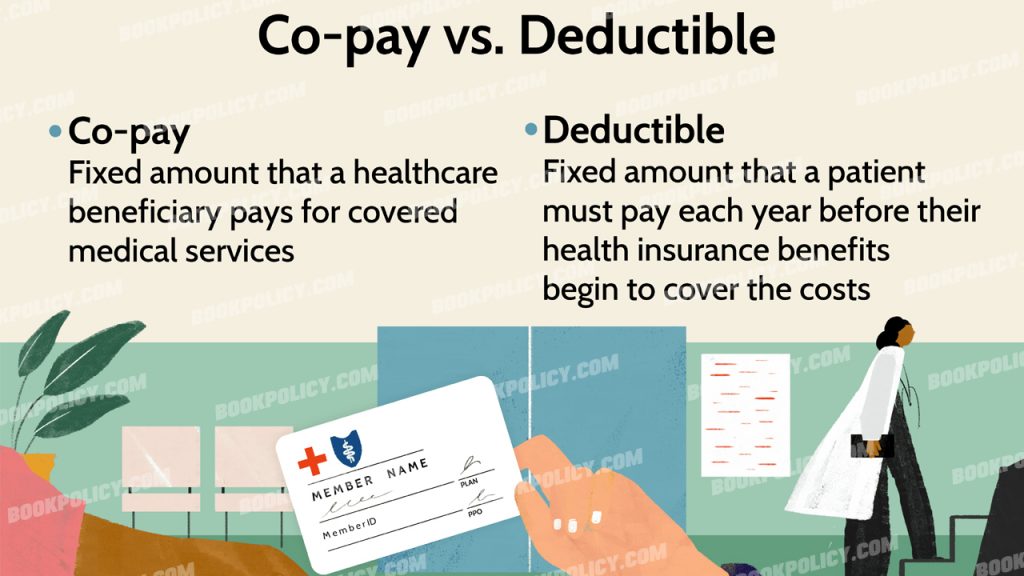

Analyze Co-Pays and Deductibles :

Examine the impact of deductibles and co-pays on your overall expenses. Lower rates are frequently the result of higher deductibles, but you’ll have to spend more before your insurance coverage kicks in.

Network and Providers Review :

If you have health insurance, find out if the insurer’s network includes your preferred medical professionals. By doing this, you can save money by avoiding out-of-network medical expenses.

Think about further advantages :

Some insurance policies include extra benefits or riders, such as coverage for catastrophic illnesses, accidents, or dental and vision care. Consider whether your situation calls for these add-ons.

Consult a professional :

Consult an insurance agent or financial counselor if you’re unsure which insurance plan to select or need help understanding complicated plans. They can offer professional advice catered to your needs.

Regularly review and update :

As your circumstances in life change, periodically examine your insurance coverage to make sure it still satisfies your needs. Your insurance needs may change as a result of life events like marriage, having a child, or purchasing a property.

Always keep in mind that insurance is a tool for managing financial risk, and the ideal strategy should be in line with your unique objectives and situation. Do your research before making a decision, and do not buy an insurance before you are certain what it covers and how much it will cost.